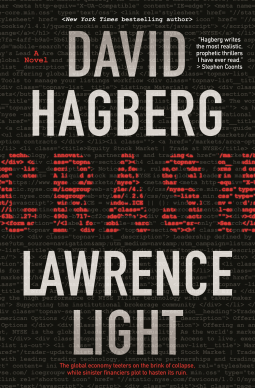

Crash

by David Hagberg; Lawrence Light

This title was previously available on NetGalley and is now archived.

Send NetGalley books directly to your Kindle or Kindle app

1

To read on a Kindle or Kindle app, please add kindle@netgalley.com as an approved email address to receive files in your Amazon account. Click here for step-by-step instructions.

2

Also find your Kindle email address within your Amazon account, and enter it here.

Pub Date Apr 28 2020 | Archive Date Jan 26 2021

Macmillan-Tor/Forge | Forge Books

Description

The second Great Depression is coming. The world’s economies are groaning under too much debt. If one thing goes wrong, the entire rickety system collapses.

Now, acclaimed award-winning New York Times bestselling novelist David Hagberg and renowned financial reporter Lawrence Light have combined forces to dramatize—hour by hour—how this all-too-real catastrophe could go down in Crash.

With debt-burdened governments and businesses worldwide about to go bust, a cabal of Wall Street big shots plot to destroy the globe’s stock exchanges. To provide that one thing that goes wrong. In 24 hours, a powerful computer worm will smash the exchanges and spark an international panic, pushing a debt-laden world into the abyss. The Wall Street gang’s investment bank will be the last one standing, able to make a killing amid the ruins.

But one person, who works for their bank as a computer expert, spots the worm embedded deep in its network. Cassy Levin invents a program to destroy the cyber-intruder. Angered by Cassy’s discovery, her bosses order her kidnapping.

Her boyfriend, a former Navy SEAL, is alarmed at Cassy’s disappearance and unravels the plot. Ben Whalen only has until the next morning to save the woman he loves and prevent the economic apocalypse.

This story is based on the genuine threat posed by towering debt, which will make the 2008 financial crisis look puny.

Available Editions

| EDITION | Other Format |

| ISBN | 9781250249890 |

| PRICE | $27.99 (USD) |

| PAGES | 320 |