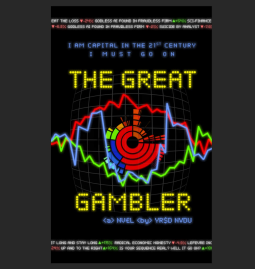

The Great Gambler

by YRSD NYDU

This title was previously available on NetGalley and is now archived.

Send NetGalley books directly to your Kindle or Kindle app

1

To read on a Kindle or Kindle app, please add kindle@netgalley.com as an approved email address to receive files in your Amazon account. Click here for step-by-step instructions.

2

Also find your Kindle email address within your Amazon account, and enter it here.

Pub Date Mar 15 2024 | Archive Date Mar 14 2024

Talking about this book? Use #TheGreatGambler #NetGalley. More hashtag tips!

Description

HARDCORE SCI-FI meets HIGH FINANCE in a story about capital in the 21st century... about money that believes it MUST GO ON.

Much of WALL STREET left its downtown namesake long ago, when its idea was replanted into the fat midsection of Manhattan. Here the hopeful and the anxious have been gathered into an awesome office-mass - one that is forever looking to make money from the idea of money itself.

Among this throng is the ANALYST - a speculator who has made a bad bet and lost too much of a client's capital. The analyst has been wound down and let go. The regular sources of capital are no longer available and so an unusual backer has to be found – a continental gentleman named LEFEVRE.

Lefevre offers a generous salary and full carry. But his contract contains strange stipulations, while he insists on calling himself a quantitative, claiming he MANAGES HIS MONEY USING MATH ALONE. Whereas the analyst is an old-fashioned student of common stocks. What use can someone like that be to a man like Lefevre?

THE GREAT GAMBLER is a three-act novel set at the black edge of Wall Street – part econ-blog con theory, part boiler-room gas.

As the analyst entangles with Lefevre, the story pulls in its other characters: a ghostwriter, a TV interrogator, a minor oligarch and - finally - a woman who has never lost a game of chance, and who was once known to the underground as THE GREAT GAMBLER.

Available Editions

| ISBN | 9798990107717 |

| PRICE | $8.97 (USD) |

| PAGES | 201 |

Links

Available on NetGalley

Average rating from 1 member

Featured Reviews

Steven S, Educator

Steven S, Educator

The Great Gambler, by the pseudonymous author YRSD NYDU, is a slightly science-fictional story about money and finance. A Wall Street analyst is hired to pick out stocks by a mysterious employer. The employer turns out to be a non-human, digital life form; finance itself somehow congealed into a sort of personhood, or algorithms that attain the temporary stability of a persona. If the atmosphere can self-organize into a hurricane or a tornado, why can't finance self-organize into an extractivist organism that accumulates and expends money? This happens when financial transactions float free of any underlying (as Elie Ayache would put it), or of any connection to the so-called 'real' economy. As the entity declares, "I am capital in the twenty-first century, I must go on." (We might consider this as the 21st-century replacement or updating of Samuel Beckett's "you must go on. I can’t go on. I’ll go on”).

The theory behind this is Jeremy England's account of "Dissipative adaptation in driven self-assembly". If, as the Second Law of Thermodynamics tells us, entropy is always increasing, then processes of self-organization (of which life is the most prominent, but not the only, example) arise spontaneously because they offer more efficient means than would otherwise exist for dissipating energy. The novel personifies and narrates this process as it applies to finance, and implicitly links it to similar strategies in 20th century literary fiction (think not only of Beckett, but also Borges and Calvino).

Unfortunately, much like others who cite Jeremy England's work from 2013 to 2015, the novel ignores the earlier development of a quite similar theory by Eric D. Schneider and Dorion Sagan, in their 2005 book Into the Cool: Energy Flow, Thermodynamics, and Life.

Nonetheless, the novel is important for the way that it grasps the workings of postmodern finance and links these workings both to other physical processes and to larger cultural patterns that we tend to take for granted without overtly realizing that we are doing so.