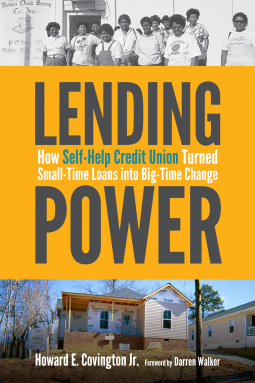

Lending Power

How Self-Help Credit Union Turned Small-Time Loans into Big-Time Change

by Howard E. Covington

This title was previously available on NetGalley and is now archived.

Send NetGalley books directly to your Kindle or Kindle app

1

To read on a Kindle or Kindle app, please add kindle@netgalley.com as an approved email address to receive files in your Amazon account. Click here for step-by-step instructions.

2

Also find your Kindle email address within your Amazon account, and enter it here.

Pub Date Oct 06 2017 | Archive Date Sep 22 2017

Duke University Press | Duke University Press Books

Description

In Lending Power journalist and historian Howard E. Covington Jr. narrates the compelling story of Self-Help's founders and coworkers as they built a progressive and community-oriented financial institution. First established to assist workers displaced by closed furniture and textile mills, Self-Help created a credit union that expanded into providing home loans for those on the margins of the financial market, especially people of color and single mothers.

Using its own lending record, Self-Help convinced commercial banks to follow suit, extending its influence well beyond North Carolina. In 1999 its efforts led to the first state law against predatory lending. A decade later, as the Great Recession ravaged the nation's economy, its legislative victories helped influence the Dodd-Frank Wall Street Reform and Consumer Protection Act and the formation of the Consumer Financial Protection Bureau. Self-Help also created a federally chartered credit union to expand to California and later to Illinois and Florida where it assisted ailing community-based credit unions and financial institutions.

Throughout its history, Self-Help has never wavered from its mission to use Dr. Martin Luther King Jr.'s vision of justice to extend economic opportunity to the nation's unbanked and underserved citizens. With nearly two billion dollars in assets, Self-Help also shows that such a model for nonprofits can be financially successful while serving the greater good. At a time when calls for economic justice are growing ever louder, Lending Power shows how hard working and dedicated people can help improve their communities.

Advance Praise

-

"This would be an important book at any time but it is especially that in a season when outrage blossoms on every corner. It is a great story about how that emotion—in the hands and hearts of good people—can do much good. It provides, in the account of Martin Eakes' work, an appealing example of genius successfully confronting inequity. If Martin had lived in the early days of Christianity he would have been one of the Apostles and at times he would have been impatient with Jesus; but the world would have become fairer more quickly." — Tom Lambeth, director emeritus of the Z. Smith Reynolds Foundation

"Martin Eakes may not look, talk, or act like any of the titans of the financial industry, but he commands respect and even fear from them. The organization he leads, Self-Help, went from making affordable loans out of a Volkswagen Beetle to running payday lenders out the state and predicting the housing crisis years ahead of time. Howard Covington's book should inspire anyone who wants to advance Dr. King's dream of economic equality for all Americans." — Wade Henderson, president and CEO, The Leadership Conference on Civil and Human Rights

Available Editions

| EDITION | Hardcover |

| ISBN | 9780822369691 |

| PRICE | $27.95 (USD) |

| PAGES | 240 |

Links

Average rating from 2 members

Featured Reviews

Reviewer 153322

Reviewer 153322

I am always an advocate for small-scale, accessible lending, whether it is microfinance globally, or institutions like the one Covington describes here. The Self-Help Credit Union is a model of community banking as well as a resource for other states drafting predatory lending laws or attempting to rein in payday loans, employers who want to put wages on heavy-fee debit cards or mortgage bundlers.